Fairing’s Dark Attribution ROI Calculator

Fairing tends to unlock previously invisible opportunities for brands, and believe it or not, there is a downside to that: you can’t really measure the ROI of your Fairing plan (at least, not without coming to preposterous conclusions like “infinity percent”). Such is the conundrum of going from 0-100; from an ROI standpoint, it’s far easier to calculate 1-100.

However: one very quantifiable aspect about Fairing is that our post-purchase surveys deliver a massive amount of attribution data to your doorstep in real-time — much of it being the initial data point on an otherwise dark conversion, which of course allows all your modeling and budgeting to function as intended. This shift in your attributable media mix happens the moment you launch Fairing, which is why we say ROI from Day 1 .

So, if you ignore everything else Fairing does, you can at least say something like, “Fairing gave me the data to solve a huge chunk of my dark attribution problem.” And the dollar value of that dark attribution data is…

Wait, how’d we get there? How much is an attribution data point worth again? It turns out, no marketer has really asked themselves this question. To most, attribution feels like air: you either have it (in which case it seems worthless), or you don’t (in which case it seems priceless).

Marketers typically just operate under an assumption that there’s the attribution you have, and then there’s the 20, 30, 40% of conversions coming in with dark attribution which are a lost cause. The problem with that assumption is 1) it’s mostly wrong, and 2) if it’s wrong, then there’s some conventional marketing behavior that needs to be rethought.

Finding Your DAVE (Dark Attribution Value Estimate)

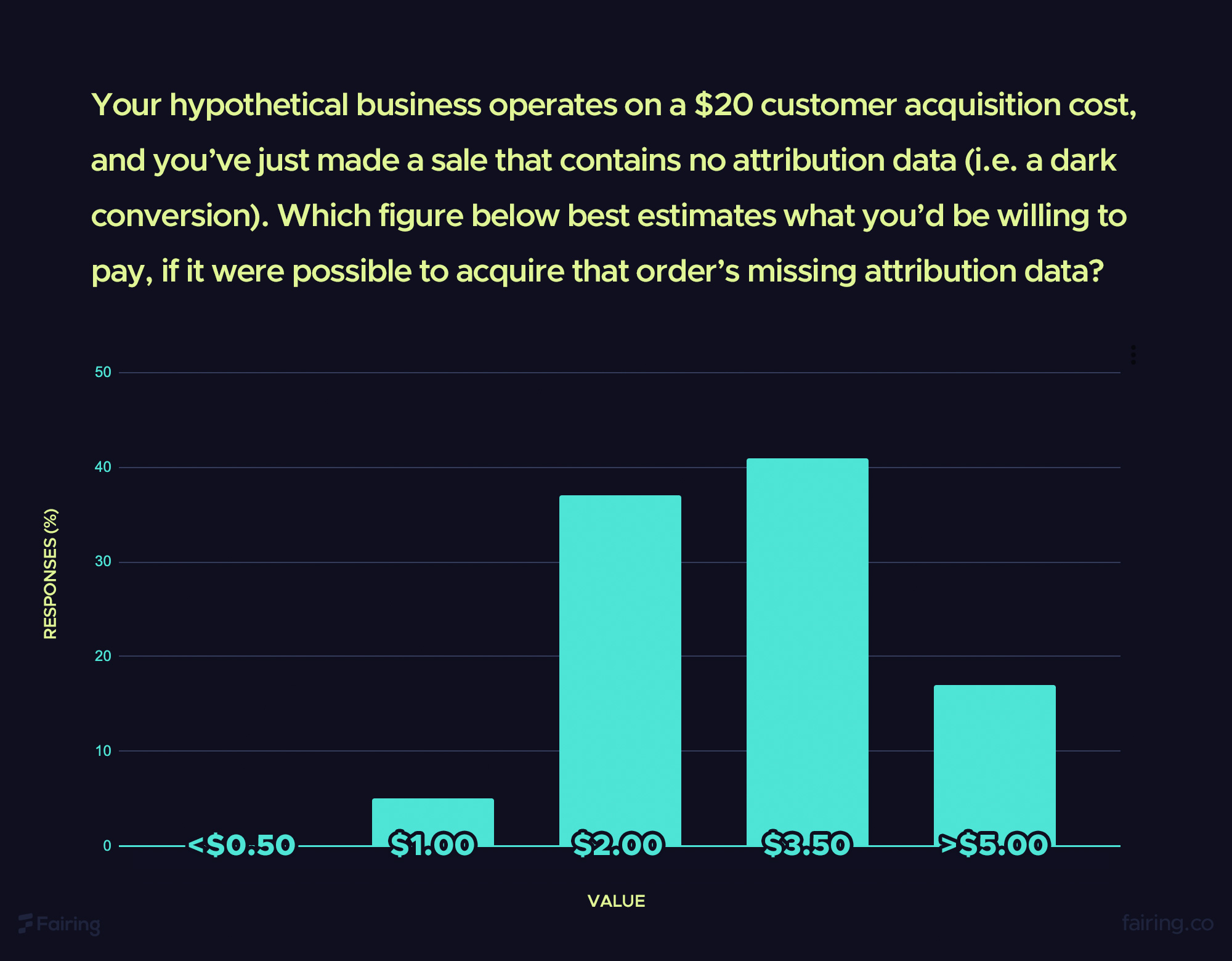

Obviously the dollar value of a dark attribution data point is non-zero, but with virtually no precedent as to what any attribution data point is actually worth, we had to do our own market research by proposing some hypothetical willingness to pay scenarios.

We surveyed 120 marketers in and outside our network, conservatively responsible for $200MM in annual ad spend, and the key number they identified is what we’ll call DAVE (Dark Attribution Value Estimate). Effectively, it’s the estimated market value of a single dark attribution data point, if you had the ability to simply buy it off a shelf.

So, what’s the magic number? What is DAVE? It’s 10% of your Customer Acquisition Cost . If your typical CAC is $20 and you’re staring at an unattributed sale that just came in, you’d pay $2.00 to acquire a reliable attribution data point on that sale.

Worth noting, this is the most conservative (i.e. unfavorable to Fairing) figure we could report. It’s the weighted average of responses, assuming the bottom of the range is what each respondent intended — for instance, if you chose “<$0.50”, we recorded that value as $0.00 rather than assuming the range’s median value of $0.25. In other words, we used a willingness to pay question format, but tempered it by recording the lowest amount in that range.

We also rounded down the actual net result ($2.44 in this case) pretty significantly. We did this in part to be as conservative as possible, given the number is an estimate after all… and in part because it’s not so easy to remember “DAVE is 12.2% of CAC.”

In our Dark Attribution ROI Calculator you previously saw, the math happening there is quite simple thanks to DAVE. You give us an idea of your unattributed sales volume, which lets us know how many dark attribution data points per day you can expect to get from Fairing (our typical response rate is ~50%, ergo you can expect half your dark attribution to be lit up). We then multiply that by DAVE (10% of your CAC), and extrapolate it to 30 days for an ROI comparison against your monthly Fairing plan cost. So there’s your Fairing plan ROI, assuming our platform had no other value to deliver.

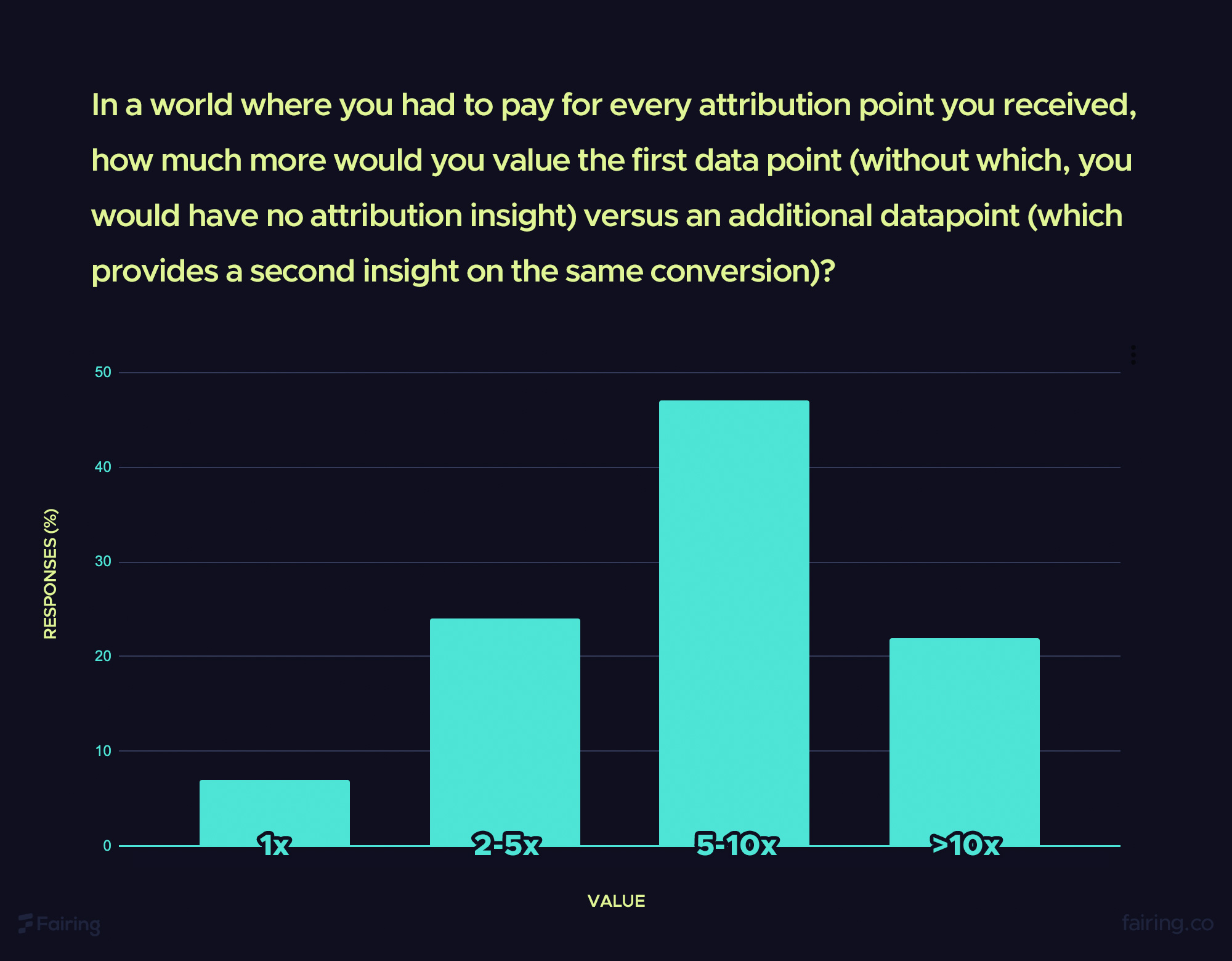

Comparing Dark Attribution Value To Additional Data Points

Of course, you do indeed see additional value from Fairing — for example, the pile of attribution data that offers second opinions on your already (pixel) attributed conversions, and keeps ad platforms from grading their own homework. But how much is an additional attribution data point worth?

Using DAVE as an anchor, our study concluded that additional attribution data points hold roughly 20% of an initial data point’s value: 2% of CAC . In keeping with the aforementioned example, it would translate to paying $0.40 for a second attribution opinion on your $20 acquired customer cost.

We could have included these secondary attribution data points as contributing additional value to your Fairing Plan ROI calculation, but it would’ve made for a less intuitive experience… and again, the calculator’s claim to fame is that it isn’t even considering any other value delivered by Fairing. Lighting up dark attribution alone is enough to offset our plan cost.

Frame Of Reference: Discount Codes

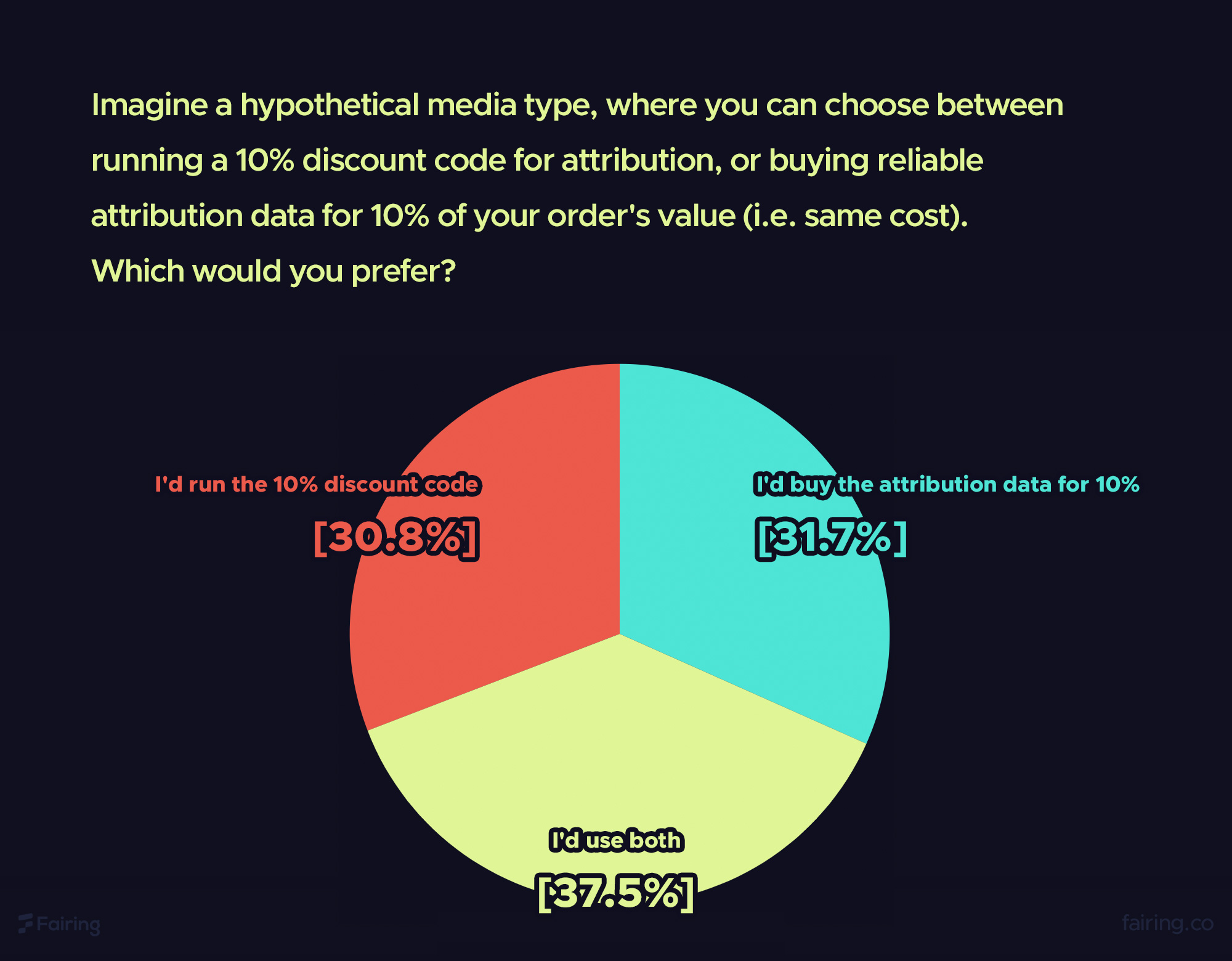

No matter how many marketers one surveys on this topic, the conclusions will still be anchored in theory rather than practice — because again, most marketers simply accept the attribution they’re given. Or do they?

Some of the hardest media to measure rely heavily on discount codes as their attribution safety net. And while these codes produce other impacts (some good, like increasing conversion rate… some not so good, like decreasing perceived value), they are in large part employed for the purpose of lighting up dark attribution. Said another way: brands buy attribution data all the time, via discount codes.

Knowing that a 10% discount is a pretty typical and modest deal, we now had a very real anchor for practical market value on DAVE. As such, we asked our survey respondents a rather bold question: if you could just buy the dark attribution data point itself for the same cost, rather than run the discount… which would you prefer?

To acquire a dark attribution data point, 69% of marketers would prefer to buy it for 10% of their order’s value instead of (or in addition to) running a 10% discount code . Understandably, there will always be some dissenting marketers who feel discount codes offer a worthwhile net benefit beyond attribution; we’re not here to rid the world of discounts. But the fact that a strong majority noted a willingness to pay 10% or more of their order value — not CAC, order value — makes an undeniable real-world argument that our DAVE figure is indeed conservative. This is further validated by the practices of our agency partners, who habitually require Fairing to be installed on a brand’s site before running experimental campaigns or hard-to-measure media , wherein discount codes are often the de facto attribution solution.

That said, discount codes are often used as temporary measures for gathering attribution, so we still think it’s best to stay conservative with our estimates.

Want To Know More?

While we were pleased to see the business case for Fairing prove itself as an ROI no-brainer, dark attribution is ultimately just one of many needs our zero party data platform addresses for DTC brands. Some of those use cases are incredibly compelling, and ones we truly enjoy revealing to our customers — so, with the financial justification now out of the way, we’d love to showcase the rest of Fairing’s value for your team. Schedule a personal demo today , or get started for free and let our Customer Success team show you ROI from Day 1.