Feature Highlight: Revenue Extrapolation

Use Case:

Cash, money, revenue, earnings, returns, yields.

All these terms refer to the same thing. For businesses, whichever you choose to use, it is the most important metric to focus on. Businesses perform different facets of work like marketing, sales, or product development for the sole overarching purpose of driving revenue.

With such heavy reliance on revenue, it naturally means that tracking and measuring your revenue data accurately is vital. Businesses use their revenue data to track how their business has been performing, to project their growth and more, among other things.

That said, regardless of the size or number of years your business has been running, revenue remains critically important.

Let’s say you’re an experienced Shopify merchant with pretty consistent revenue numbers and have experimented with different marketing strategies. You recently started using Fairing and are trying to expand your business, publishing your own post-purchase survey with vital attribution questions like “How did you hear about us?”.

Having let your attribution survey run for a few months now and gathered pretty considerable data, you’re able to accurately see which channels have been working for you. Overall, you found that at a 50% response rate, your influencer marketing, podcast advertising, and word of mouth has been the most successful respectively.

|

Response |

Response Count |

Percent (of responses) |

Revenue |

|

Influencers |

2500 |

35% |

$21,000 |

|

Podcast |

1750 |

27% |

$15,700 |

|

Word of mouth |

1200 |

21% |

$11,900 |

Table 1: Revenue data example

Further analyzing your data, you find that the difference between the revenues attributed to the 3 channels isn’t too drastic. Compared to the rest of your channels (not included in the table), these are way more significant.

You now are deciding whether to invest in just your top channel, your top 2, or even your top 3. From this view, it looks like investing the differences between the 3 are minimal. This is where revenue extrapolation comes in.

|

Response |

Response Count |

Percent (of responses) |

Revenue |

100% |

|

Influencers |

2500 |

35% |

$21,000 |

$42,000 |

|

Podcast |

1750 |

27% |

$15,700 |

$31,400 |

|

Word of mouth |

1200 |

21% |

$11,900 |

$23,800 |

Table 2: Extrapolated revenue data example

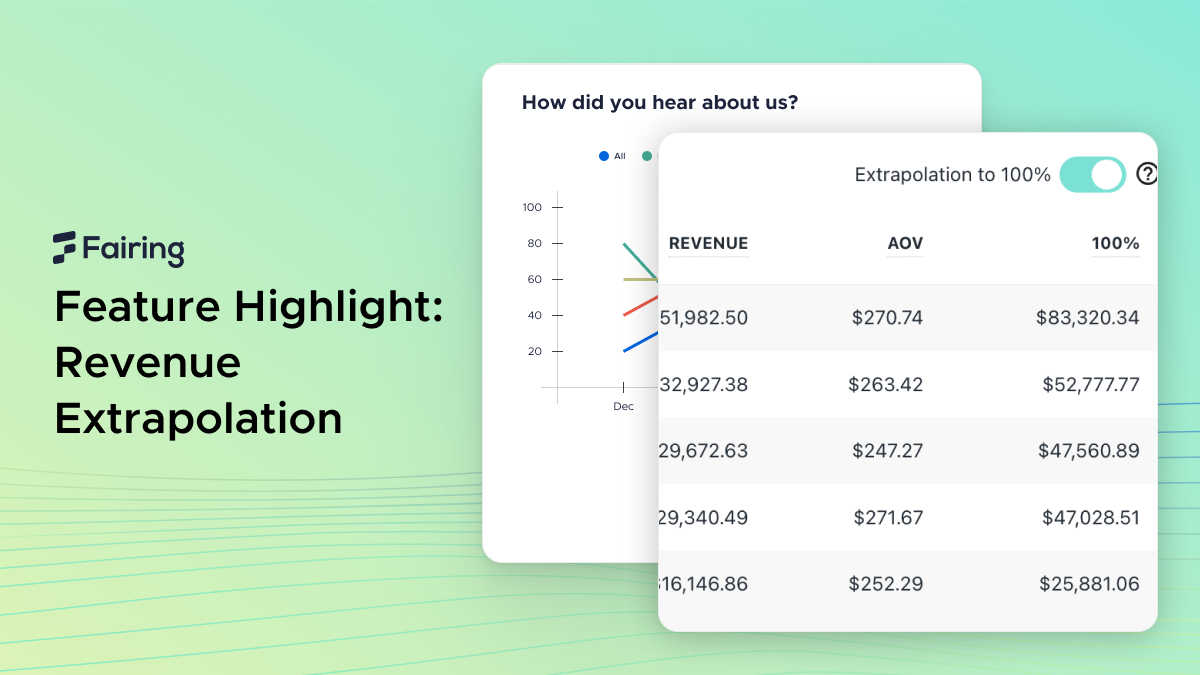

When toggling the revenue extrapolation feature, we now more accurately see your business’ revenue numbers at a 100% response rate as compared to the actual 50%.

Looking at the data now, the differences between the top 3 channels are more obvious. There are more significant differences in the revenues generated within them. Thinking about it again, you ultimately decide to focus on and invest in your top 2 channels instead of splitting it across the 3 due to the revenue numbers.

Not only does revenue extrapolation allow for more accurate data analysis, it also gives you a clearer direct picture of how your revenue is faring.

Why we introduced it

Accurate viewing of revenue

An extrapolation is an estimation of values based on the extension of a known series consisting of existing data to make predictions. Extrapolation is an essential method in data analysis that’s used to predict future trends and outcomes.

This feature was introduced to facilitate true data comparisons and analysis. Due to the nature of surveys, response rates will never hit 100%. This impacts the revenue numbers that you’re seeing in your Fairing dashboard, and it’s a shared problem across any and all data platforms. The extrapolated revenue numbers are for your business to perform such analysis.

Merchants will want to look at extrapolated numbers for any comparisons because the smaller number is just a small piece of your total sales.

Limitations to revenue extrapolation - Non-response bias

Due to a phenomenon called non-response bias, we recommend working to get your question completion rate > 50%. At response rates below 50%, it will affect the accuracy of your extrapolated numbers.

Non-response bias is where response data may not accurately reflect your entire customer base due to biases in either the group that responded or did not. The bias can cause inconclusive results in your research due to a larger variance for estimates and the sample no longer being representative of the population as a whole.

In other words, a non-response error occurs due to an increase in the range of your responses related to the decrease in sample size. It’s to be noted that non-response bias does not always have a negative effect. Hence as a solution, a response rate greater than 50% is often seen as sufficient.

How does it work

For the magic behind the calculations, we simply take the revenue numbers shown under the Volume column and divide it by your question response rate.

So, if your response rate sits at around 50%, we divide your revenue data by 50% to re-formulate it to configure the response rate at 100%.