This holiday season’s CPMs are likely to be atrocious, to say the least. Leaning on current customers through email & sms channels has always been a foundational strategy of BFCM — but now more than ever, repeat and expansion revenue may just save your Q4 from its acquisition costs. Trouble is, your success here rides on customer segmentation.

To hear Klaviyo tell it (and with billions of emails served, they might know a thing or two), a highly segmented audience returns 3x the revenue of an unsegmented audience, with half the unsubscribe rate to boot. Now, Klaviyo defines a “highly segmented” list as less than 20% of your total customer base — and that’s not the only best practice criteria:

- Optimally, target 5% or less of your total customer base

- Define the segment by two or more conditions (e.g. location + gender)

- Include specific recipient behavior

These are wise recommendations, but they lead to an obvious question: how do you segment your entire customer base into 20 different yet intentional groups? Where do you get all these segmentation conditions from?

That’s precisely where Fairing comes in, and if you’ve only been using our post-purchase surveys for attribution, you’re about to learn a massively useful lesson for winning the BFCM inbox: customers want personalization, but they want it on their own terms. And luckily, that means the answer is as obvious as the question: let them self-segment.

“How are you planning to use our product?”

Having this question in your Question Stream packs a serious segmentation punch, especially when you add follow-up questions into the mix.

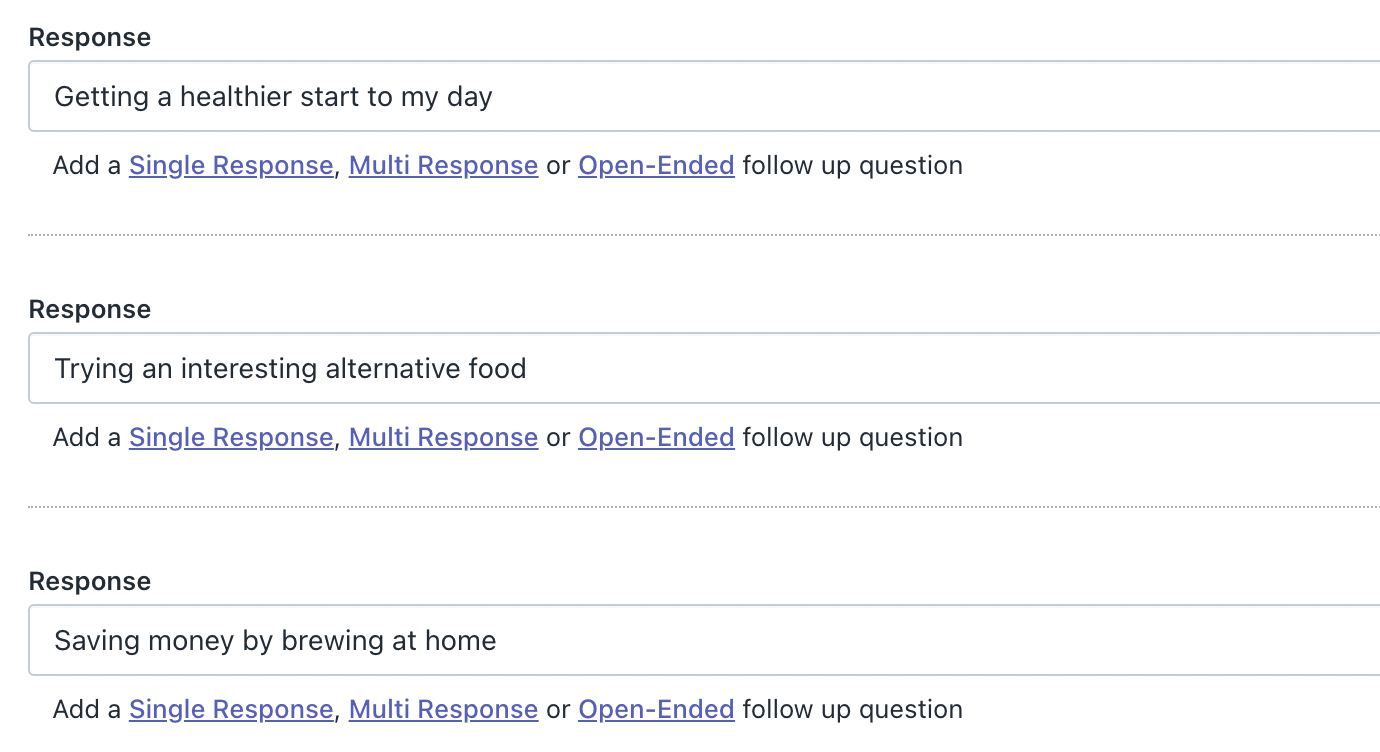

First off, plug your most distinctive value props into the list of response choices. Selling mushroom coffee? Maybe your use cases look something like this:

Already, your consumers are revealing their personalization preferences. Perhaps your Money Savers segment should get a sale or bulk discount offer, while the Fearless Foodies segment could get an inside track to new flavors or product lines launching? Certainly doing the reverse sounds like a bad idea, which is exactly why segmentation is so important.

Now let’s boost this question further. Add a fourth choice:

You just learned something for free that traditional retail brands spend six figures to figure out (and can’t even take action on, since they have no direct customer relationship). So keep the ball rolling and list your target competitors in a follow-up question: “Which brand are you switching from?” Now you’ve got multiple lists of customers segmented by the brands you conquested them from — and assuming you know (or decide to ask) what makes you stand out from each competitor, you’ve also got the makings of some compelling messaging & offers once BFCM drops.

We’re not done yet. Here’s a fifth choice:

One of the biggest segmenting issues in business is the buyer vs. user problem: separating the person swiping their credit card from the person who’s ultimately going to use the product (the Toy category is a great example). For obvious reasons, this creates a huge opportunity in BFCM segmentation — you’d want to serve vastly different experiences to the customer who has never actually used the product.

Perhaps not so obvious is what you could ask in a follow-up question: “Who is this purchase for?”

- Someone in my household

- Friend or relative

- Client or coworker

You see how each of these responses lights up a different path to a highly personalized brand experience, yes? Yeah, you see it.

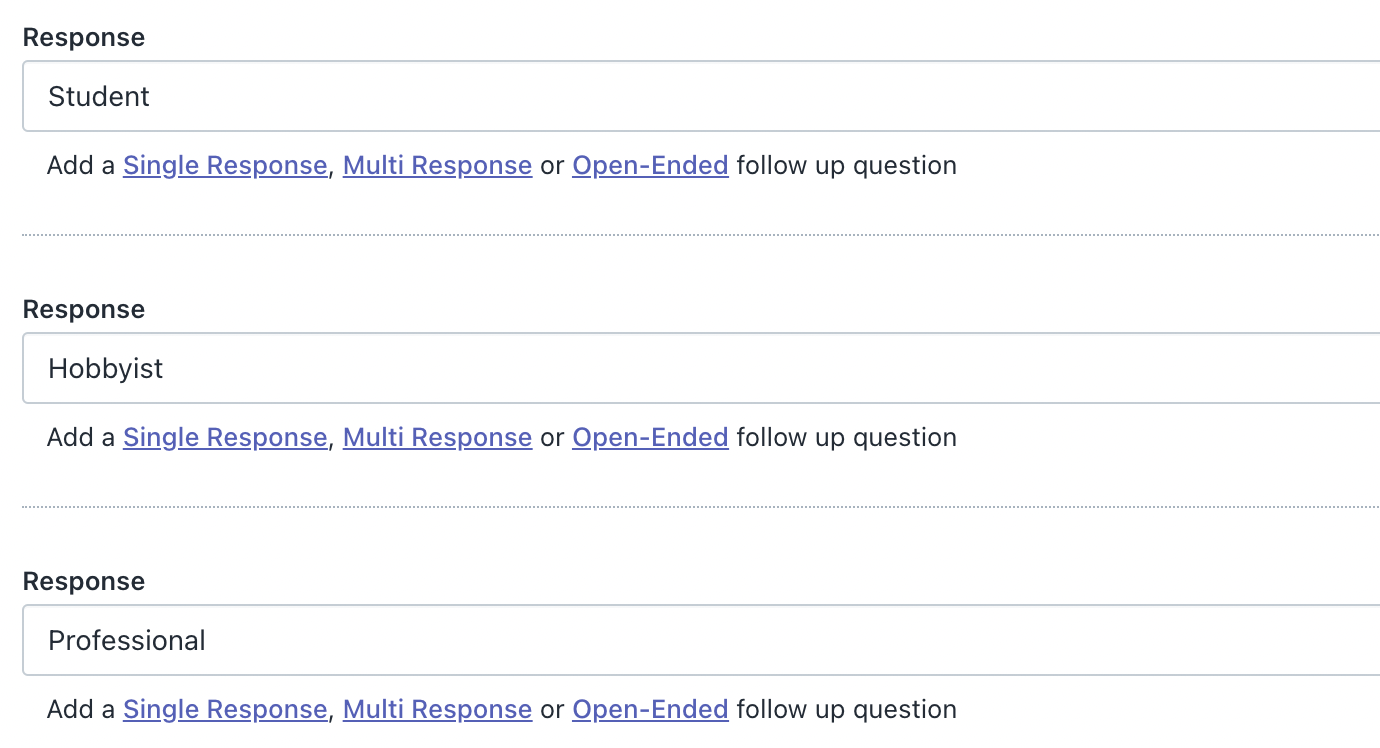

“How would you classify yourself?”

Don’t overlook the value of testing your core assumptions — the unknown knowns. On a recent Subscription Radio appearance, our CEO told the tale of a niche electronics brand that believed roughly 3/4 of its customers were professional users. Then, they actually asked shoppers to self-segment as Student, Hobbyist, or Professional:

It took just two days to learn that Professionals comprised a mere 20% of their customer base; the brand had massive opportunities to expand their market & message. This is the kind of insight we’ve habitually seen from Fairing brands, and one of the reasons we recommend this question as one of the first to ask during your 14-day free trial.

A few of the BFCM-centric tactical takeaways this data provides:

- Create real user persona segments so your messaging and timing are hyper-relevant; especially if you want to take the step to retarget them on social

- Cross-reference “How did you hear about us?” responses with these personas to surface your under-the-radar marketing channels (maybe students are finding you on Reddit, while pros hear about you organically on podcasts… both of those channels will gladly run ads for you)

- Take a look at the AOV across these customer segments — chances are, the ads you buy and sales you run during BFCM haven’t been ROI-optimized because you’ve never had persona-segmented AOV metrics before. Well, now you do… so any decisions on media spend and profit margin can be properly targeted to produce ROI

- All the above becomes part of a much more actionable post-BFCM analysis, setting you up for next season’s success

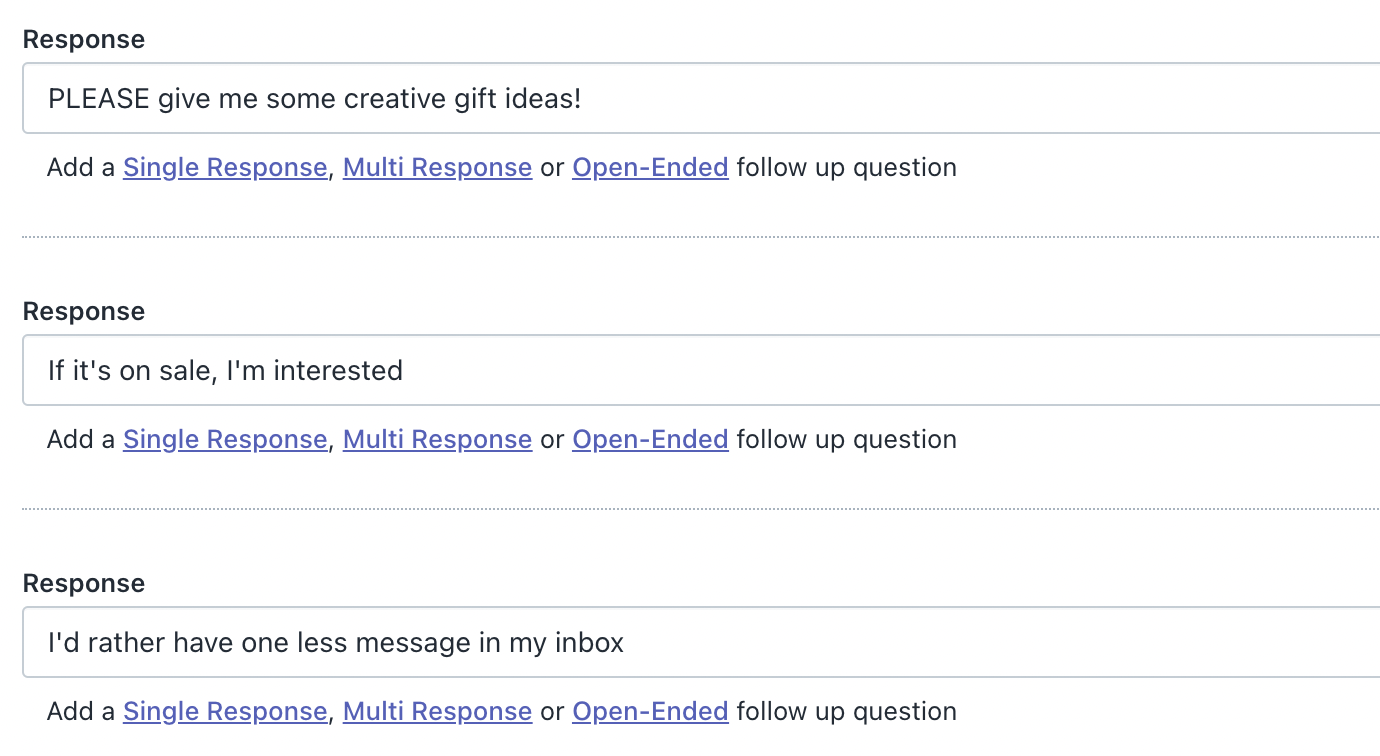

“What kind of holiday offers do you want to see?”

Think this is too meta? Not a chance… they’re your customers! These people want you to be aligned with their preferences and interests. When in doubt, don’t overthink it: just ask them.

It’s pretty tough to beat BFCM segmentation where your customers actually tell you what message they want to get ahead of time. It’s also a great canvas to paint some of your brand voice onto, providing response choices that speak to your customers in a way they won’t see anywhere else.

If you change nothing else about your Question Stream during the holidays, this high-intent question is probably the easiest way to grab a segmentation datapoint that directly correlates to desirable offers. And from the looks of this example, you’ll even carve out a cohort to avoid spamming during BFCM — which not only reduces unwanted unsubscribes, but also shows that you listen to your customers and builds trust, which ultimately builds LTV.

For those of you who haven’t been using your Question Stream to gather personalization & segmentation data, it’s certainly not too late to start — and if you haven’t set up one of our simple integrations with Klaviyo or another ESP, the Fairing API is literally your key to unlocking all this BFCM segmentation value with just a few clicks.

A snippet from @hiwonderment's post-purchase marketing chat: every day you're not talking to your customers is a day of data lost.

— Fairing (formerly EnquireLabs) (@FairingData) September 1, 2022

Go check out the whole Spaces recording if you missed it... plenty of gems from @juniphq and @TydoTweets in there as well!https://t.co/3qGBCj5HnQ

Want to learn how to set up your post-purchase survey for your brand? Read more here.