Our latest Question Of The Day sheds light on perhaps the most titillating of topics: competitor insights. Legacy retail brands will spend six figures over six months to glean directional data on competitive share shift — whereas you, our fine Fairing friend, can get a pulse on your competitor penetration tomorrow at no additional cost. Viva la DTC.

Question Architecture

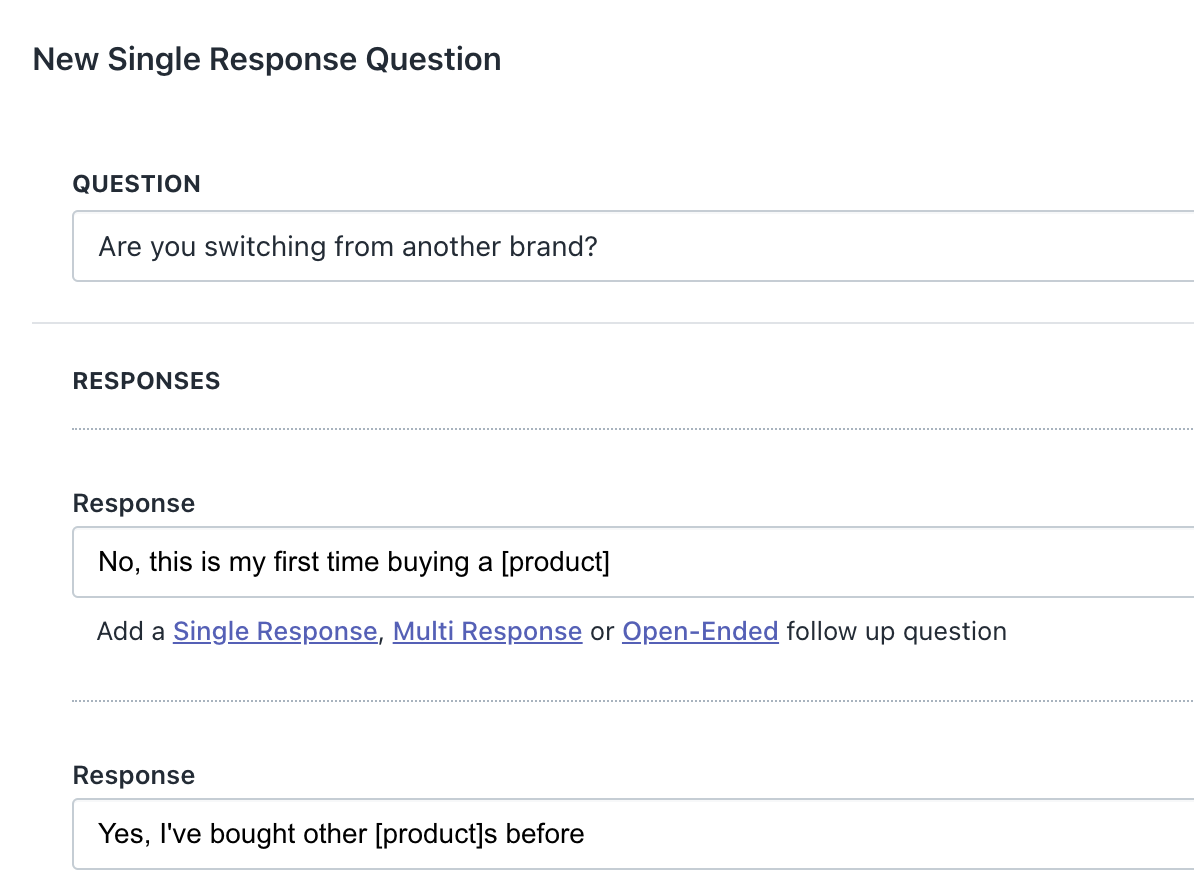

Within your Question Stream, there are two ways to ask this question. The first is a higher-level ask, which can be good if you’re still early in customer understanding and also avoids directly mentioning competitors: “Are you switching from another brand?”

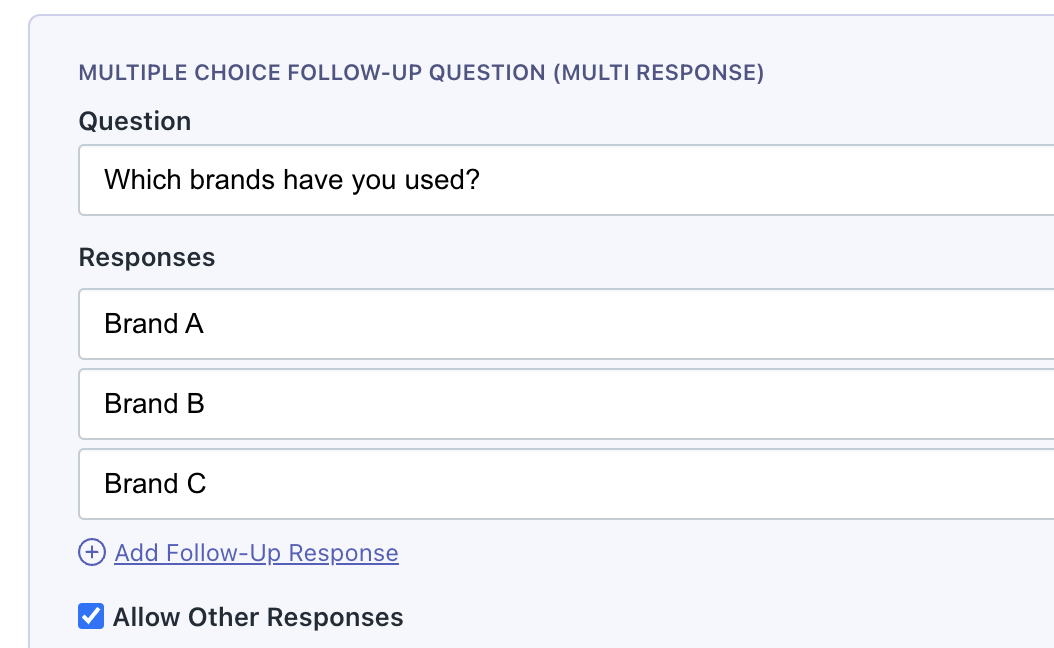

Responses of no are a great segment to carve out in your Klaviyo et al integrations, as it means your brand is teaching the consumer almost everything they know about this category. But if the response is yes, that’s your cue to use the follow-up question functionality and find out precisely which brand you’re winning market share from — an otherwise known-unknown data point if you don’t talk to your customers.

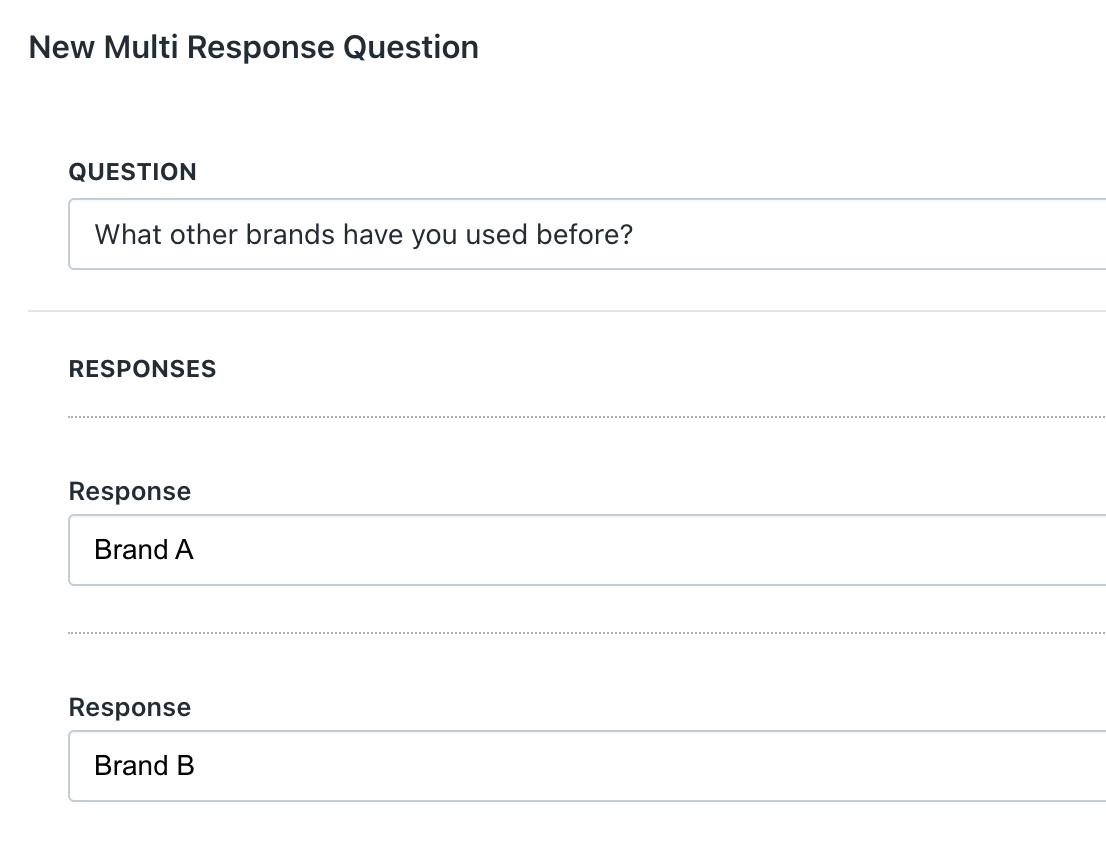

The second approach is directly geared towards learning more about a customer’s experience with your category: “What other brands have you used before?”

This question creates the benefit of moving right along to a juicier follow-up. For instance:

“What made you want to switch?” is a direct-from-consumer testimonial of your competitive advantages, and the features worth highlighting more often.

“How often do you buy this kind of product?” paints a picture of the relationship between brand spend and category spend — market share 101 in the CPG space. It also gives you an advantage over other brands, because you’ll now know something they don’t about this customer’s purchase cycle.

“Does anyone else in your household use a different brand?” reveals an opportunity to capture an entire household of customers by segmenting this audience for future bundle deals. Use Cases: Consumer Research, Competitor Share Shift Brands like Quip have asked these questions post-purchase for years, not only for tactical purposes such as optimizing ad creative or competitive bidding, but also for more strategic pursuits around fundraising and market expansion into big box retailers.

Pushing this data to one of our BI destinations like Peel or Daasity is also immensely valuable, as the ability to trend competitor penetration or track brand loyalty among cohort audiences places you at the forefront of DTC product strategy — and right up there with the traditional retail brands who will still be waiting for their expensive research results long after you’ve made a data-driven decision.

This article is part of our Question Of The Day (QOTD) series, where Fairing teams up with the industry’s smartest qualitative marketers to deliver best practices and unique perspectives in the art & science of questions. Are you a question authority? If so, our customers would love to hear from you.