Reveal The Total Effect Wholesale Has On Direct Ecommerce Sales, Using Post-Purchase Surveys

This is a partner guest article by Nick Doren, Senior Manager of Growth

at Part and Sum. Learn more about Part and Sum

here .

Just as everything else, online acquisition

costs

continue to rise every year. Part of the reason why modern online

advertising is so effective is that it allows new brands to quickly

reach “in-market” audiences, or those that are already shopping for your

product category and are ready to buy. However, as a brand continues to

seek top line expansion, it must start advertising to less qualified,

out-of-market audiences.

These audiences need more education, convincing, and brand imprinting to

make a purchase. This added effort equates to more dollars spent on each

marginal customer and leads to a loss of advertising efficacy and

increased customer acquisition costs, or CAC, as it is often referred

to. Eventually, this environment of ever-increasing costs and declining

efficiency becomes unsustainable.

Because of this, many brands become motivated to explore distribution &

discovery channels outside of traditional paid media. Wholesale partners

are a logical next step. They provide brands with something paid media

cannot: an influx of potential customers seeing their products without

additional dollars spent on advertising. Large retailers like Nordstrom,

Saks Fifth Avenue, and Revolve have curated years of brand equity and

trust and are rewarded with large swaths of customers coming both to

their physical stores and websites to find new products every day.

Wholesale partners are a source of discovery for the brands that occupy

their shelves. When going into wholesale, brands must understand that

these retail partners are not only an additional revenue channel for the

wholesale side of their business, but also an added online customer

acquisition channel with spillover effects on their online DTC business.

Let’s examine just how much of an impact wholesale discoverability has

on online direct ecommerce sales using real data Part and

Sum collected for a long time client and

partner.

Lizzie Fortunato is a New York city

based women’s jewelry and accessories brand with strong wholesale

distribution (both brick & mortar and online) in outlets like Nordstrom,

Revolve, and ShopBop. While long suspected, it was only recently proven

that these wholesale partners have the added benefit of driving quite a

bit of sales volume directly through lizziefortunato.com.

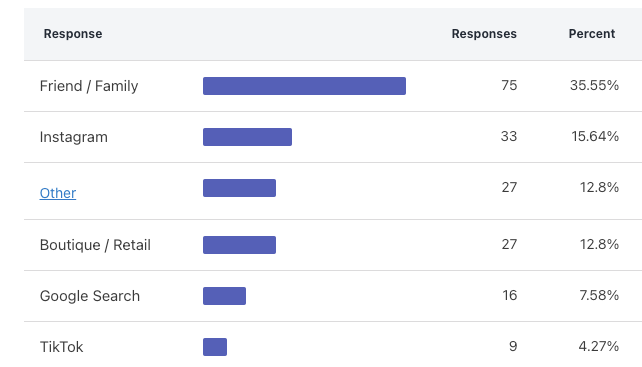

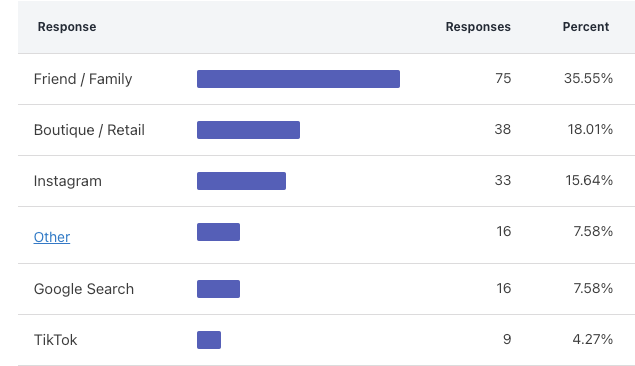

In a separate effort to better understand sources of new customer

acquisition, Part and Sum advised Lizzie Fortunato to install a post

purchase survey Shopify app on their checkout page to ask new customers

“Where did you FIRST hear about us?” In addition to getting clearer data

on the impact that online advertising channels drive for the brand, it

also became apparent that 12.8% of all new customers self-report

discovering the brand through wholesale partners.

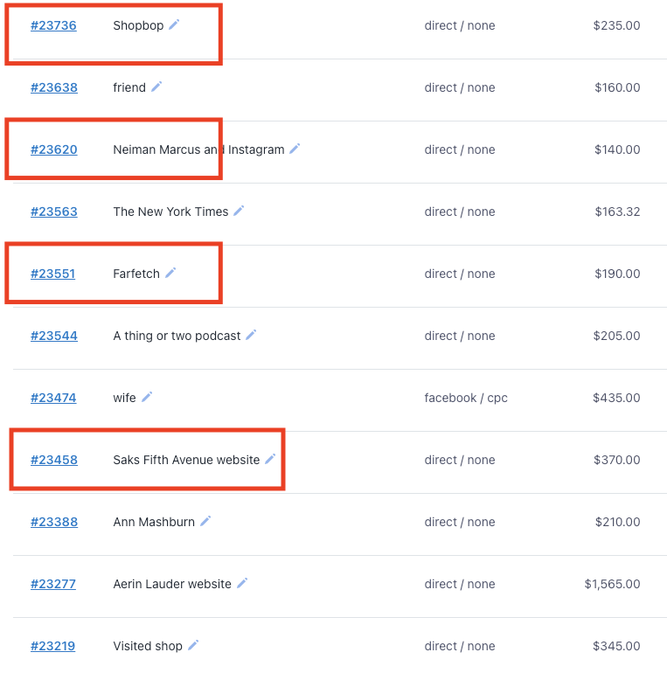

However, when digging into the “other” bucket of responses, the post

purchase survey reveals that the percentage is actually higher than

initially reported. Many self-provided-responses refer to wholesale

partners the brand sells through and therefore should be categorized

under the “boutique/retail” bucket of responses.

Using Fairing’s new Response Data

Reclassification

, which allows for manual recategorization of open ended responses, we

reassigned these uncategorized long-form answers into the appropriate

categories and discovered that over the last few days, 18.01% of new

customers that purchased directly from the lizziefortunato.com website

first found the brand through a wholesale partner!

Having access to this data when entering wholesale is critical. As a

marketer, it helps rectify an influx of previously undetectable and

miscategorized conversions on a last click basis. Brands fortunate

enough to score a large wholesale account may experience a large

spillover effect of sales to their ecommerce site as a result of the

additional discoverability and awareness that physical and online

retailers provide.

If a brand is stocked in a physical store, the discrepancy in conversion

tracking is obvious - one cannot “click through” from a physical

shopping experience to the brand’s ecommerce site. Similarly, there’s a

lack of direct click through data from an online wholesale partner. A

brand’s wholesale partner will not externally link to the brand’s own

ecommerce site for an obvious reason: they want to claim that revenue

for themselves. Any traffic and conversions generated from these points

of discovery will come through reports that emanate directly - ie. a

user types the brand’s URL directly into the address bar, or through

organic / paid branded search.

This leads to three potential marketing problems:

- One: the marketer is unable to identify what’s causing the spike in

unattributable direct & organic sales and cannot properly allocate

budget.

- Two: the marketer mistakes a lift in organic / paid search to

halo-effects driven by paid social advertising and incorrectly

assigns credit to these platforms for the additional performance.

They then mistakenly increase budgets on these channels assuming

they are producing more results than they actually are.

- Three: the marketer sees a lift in paid branded search and allocates

more spend to bidding on the brand’s own keywords, even though these

last touchpoints in the acquisition journey are largely

non-incremental.

The impact on overall allocation of resources at the business level is

perhaps more important to consider. Brands selling through wholesale

partners receive periodic reporting from retail partners - either weekly

or monthly as to how well their product is selling through. At the end

of the year, let’s say a fictional brand is generating $10 million in

revenue directly through their ecommerce website and $10 million in

revenue through wholesale partners. As a result, the business allocates

50% of their resources (staff, investments, production) towards growing

wholesale and 50% towards growing direct ecommerce.

The same brand implements a post purchase survey and discovers that 20%

of their ecommerce new customers are finding the brand through

wholesale. This discovery prompts the business to reallocate resources

more heavily towards wholesale since it’s proving to have synergistic

effects on their overall business growth. This level of insight and

control is not possible unless there is a system in place to discover

the key drivers of their ecommerce revenue beyond last-click reports.

As brands continue to see customer acquisition costs rise across the

board using paid media, they need to leverage alternative discovery &

distribution channels like wholesale. It is important they have a system

in place for reconciling the additional messiness these channels create

in attributing revenue on the direct ecommerce side of their business.

With Fairing, Lizzie Fortunato now has a better understanding of a

formerly “black-box” portion of its online revenue and can more

accurately allocate attention and resources to the different channels it

sells through, leading to smarter and more efficient growth in the

long-term. As a trusted partner to our clients, Part and Sum welcomes

the difficult challenge that attribution presents and works hand-in-hand

with brands to introduce the necessary data collection efforts so that

as a team, we can understand the most effective ways of pushing the

brand forward to its next stage of growth.