QOTD: Who Is This Purchase For? The Buyer vs User Problem

In today’s Question Of The

Day ,

we’re going to tackle the Buyer vs User problem with the simplest of

solutions: a single question that lets customers

self-segment

, and subsequently helps to keep your audiences (and business metrics)

tidy.

The Buyer vs User problem plagues most businesses, whether they’re

selling sunglasses DTC, or selling software B2B. It’s the challenge of

having to market and sell your product to someone who is purchasing on

behalf of someone else.

In some corners of commerce, this is just the nature of the beast. One

good example is the Toys & Games category; there’s virtually zero

overlap between the people who buy these products and the people who use

them. What’s more, the buyers often have totally unrelated (or even

opposing) value criteria from the users, such as price or build quality.

But interestingly, the Buyer vs User problem occasionally pops up in

almost every category when the purchase in question is a gift. Think

about Housewares : wedding & baby registry gifts, housewarming

gifts, Mother’s Day gifts… even though Housewares is a staple category

for any home, there’s no shortage of occasions where the product

purchased is intended for someone else.

What’s tricky about the gifting audience (those of your customers who

are buyers, but not users) is that they’re unlikely to identify

themselves -- and depending on what ratio of your customer base they

make up, that audience can throw a wrench into your ability to analyze

retention and engagement. What’s more, it’s obvious that you’re not

delivering the optimal customer experience to a buyer if you mistakenly

assume they’re a user.

Luckily, there’s a fix for that… and you can plug it right into your

checkout flow.

Who Is This Purchase For?

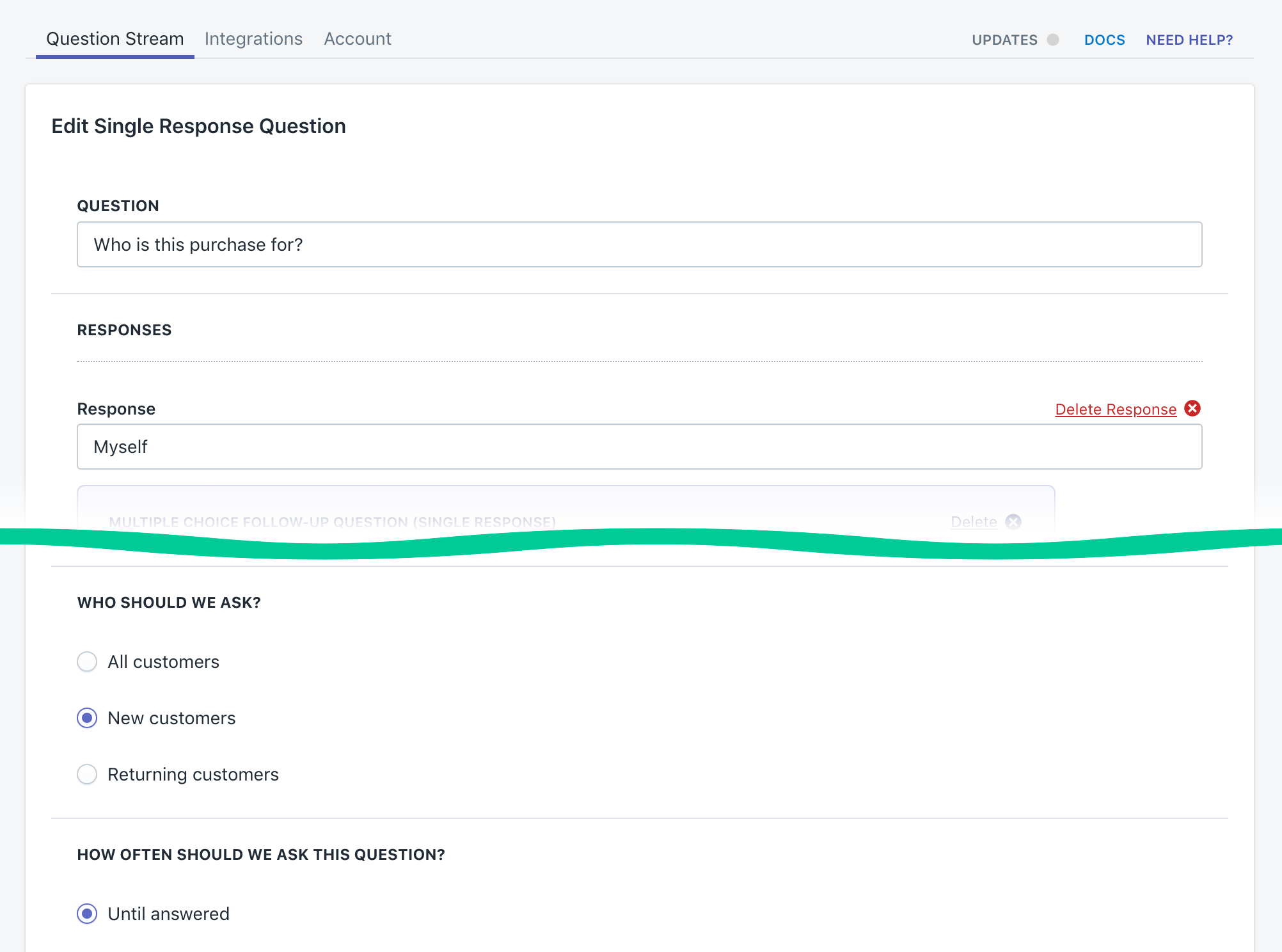

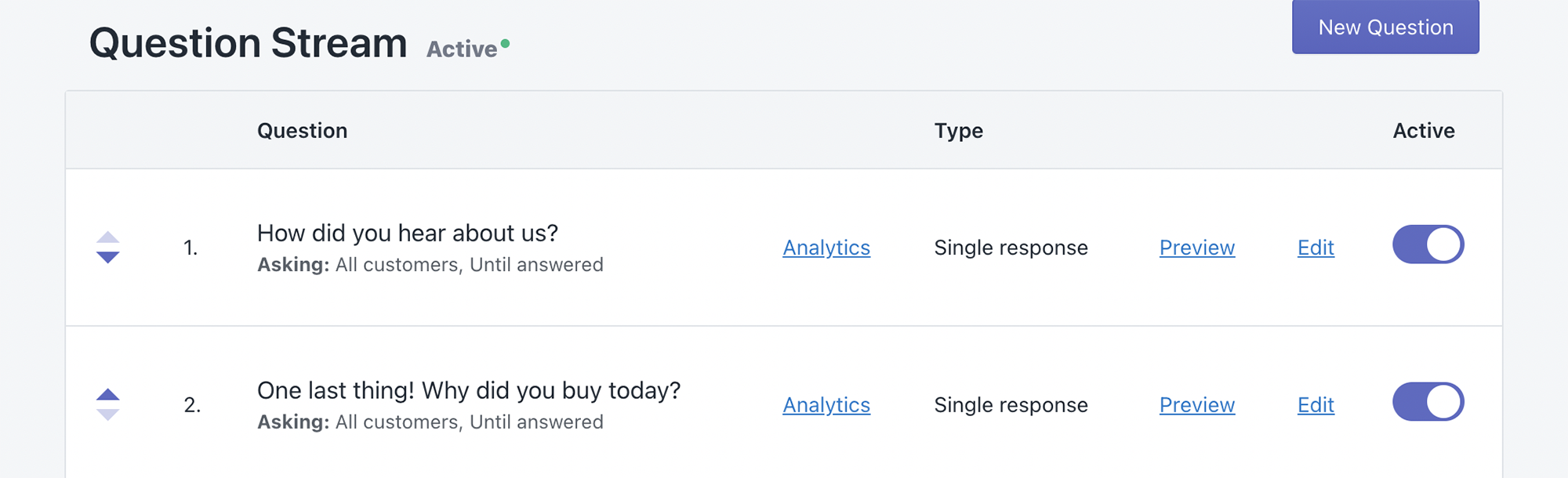

Crack open your Fairing Question

Stream™ , and set up

this simple question to ask New Customers, Until Answered. Our

recommended response options are below, but follow your heart (and your

market fit):

- Myself

- Friend or family member

- Co-worker or client

- Other

Like many post-purchase survey questions, this one packs a ton of

insight into a simple DFC interaction. Let’s take a look at some of the

learnings to be had here:

First and foremost, any answer other than “Myself” automatically

segments the shopper as a buyer, not a user. This distinction is crucial

for your marketing automation workflows (especially if you don’t already

have a workflow for gift-givers), to ensure you’re delivering the most

useful content. After all, this is a potential future customer who

already knows what you offer, and where to get it -- and they know

someone else who advocates for the product. You’ve cleared so many

hurdles to a conversion by this point!

Segmenting the gift-giver audience also helps to clean up your

performance metrics. Splitting your customers between the Buyer vs User

will typically reveal the former group to have higher churn and lower

content engagement, to say the least. You’ll get a better idea of how

your custom relationships perform and trend once you’ve split these

groups up.

Of course, that’s not to say buyers are all low-volume, one-and-done

shoppers. One of the reasons we suggest the aforementioned response

options is that a gift-giver can often have a more predictable

repurchase window than a traditional customer. “Co-worker or client”

respondents, for instance, might be open to purchasing several of the

same product for different users, or repurchasing during the holiday

season -- a sales opportunity made even more appealing by the fact that

such buyers are likely swiping corporate cards rather than digging into

their own pockets. “Friend or family member” respondents purchasing for

a birthday or holiday can easily be reminded as the next notable date on

the calendar approaches (do you still get those 1-800-Flowers email

reminders that it’s your aunt’s birthday next week? Yeah, us too.)

Beyond that, learning what products perform best as gifts can guide

additional business metrics and decisions. One Fairing client, Pastreez,

used the “Who is this purchase for” question to get a grip on the

variance of their AOV: when the dust settled on customer responses, a

clear distinction emerged between user AOV and buyer AOV, where the

latter segment was spending 100% more per order.

All these insights are made more powerful when you ask a follow-up

question or

response clarification using our platform. Here are a few rather unique

tactics, once the first response segments the shopper as a gift-giver:

- “What convinced you to buy this product?” Get a pulse on the drivers

behind your gift audience potential by finding out how many bought

because of price, as opposed to a particular selling point, or

simply because the recipient asked for the product.

- “Would you ever consider this product for yourself?” Confront the

opportunity head-on and learn whether this shopper should be in your

pipeline; route them to the appropriate automation workflow based on

their answer.

- “How will you describe this product to the recipient?” A

refreshingly left-field question, as any good entrepreneur will tell

you that the people who pitch their products best are the customers.

Ask this to gather a slew of consumer-generated one-liners and

keywords.

The options are endless for what you can ask as a follow-up here, and if

you’d like to check out some more, see our Question

Bank for

best practice questions submitted by top performing DTC brands and

survey methodologists.

In closing: no matter what you sell, you’ve got a Buyer vs User problem

-- but just by talking to your customers, you can turn it into

opportunity.

This article is part of our Question Of The Day

(QOTD)

series, where Fairing teams up with the industry’s smartest qualitative

marketers to deliver best practices and unique perspectives in the art &

science of questions. Are you a question authority? If so, our customers

would love to hear from you.